Quick personal note: Dead crypto projects happen all the time. I once almost bought into a tiny token because the marketing looked slick. It took me five minutes checking the repo and explorer and I bailed — no commits for a year, zero transactions, and a Discord with bots posting memes. This saved me a small fortune I’d probably have lost. So yes, those five minutes matter.

Crypto can feel like a land of endless opportunity — programmable money, DeFi, and new business models popping up every week. But for every blue-chip success there are dozens (if not hundreds) of projects that slowly fizzle out or crash and burn. These are the “dead coins” — tokens and protocols that lose value, stop being developed, or vanish from exchanges. If you’re investing or partnering in crypto, spotting these early can save you a lot of pain.

What are dead crypto projects?

A dead project is basically any token or protocol that’s no longer functioning as intended. That might mean development stopped, the token lost almost all value, users and liquidity left, or the team disappeared. Whatever the cause, dead projects are high-risk: tokens can go worthless, contracts can get exploited if not patched, and you might not be able to sell when you want to.

Why projects die — the usual culprits

- Developers walk away. No one patches bugs or builds features. It happens more than you’d think.

- Broken tokenomics. If the incentives don’t make sense, people sell and never come back.

- Liquidity dries up. Low trading volume makes buying or selling painful.

- Community fades. Crypto projects live off their communities. Lose that, and you lose momentum.

- Governance stalls. If no one can make decisions, the project freezes.

- Hacks or fraud. Security failures or shady behavior kill trust fast.

- Market shocks. Bear markets or macro events can bury otherwise decent projects.

Key red flags to look for (no deep tech skills needed)

- Little or no developer activity

No recent commits, few contributors, or repos that feel abandoned. Why care: If the team’s not working, bugs won’t get fixed and the project can rot.

How to use: GithHub or GitLab. Open the project repo. Look at recent commits, number of contributors, open issues, and releases.

Red flag: No commits in 3–6 months or a single person doing everything.

- Almost zero on-chain activity

Barely any transfers or active wallets interacting with the token. Why care: Without real usage, value is just speculation.

How to use: Block explorers (Etherscan, BscScan, etc) – Check transfers per day, active holders, and whether the contract is verified.

Red flag: Almost no daily transfers or unverified contracts.

- TVL is collapsing (for DeFi)

Total value locked plunges or sits near zero. Why care: TVL shows how much trust and capital is still in the protocol.

How to use: Use CoinGeck or Coin Market Cap. Check trading volume, listed exchanges, and price history.

Red flag: Sustained very low volume or sudden delisting.

- Tiny trading volume or delisting

Volume under practical levels for months, or exchange delistings. Why care: Low liquidity = hard to exit. Delisting makes it harder to find buyers.

How to use: Use tools like DefiLlama / DappRadar / DeBank. Check TVL trends and where liquidity sits.

Red flag: TVL falling fast or concentrated in a few addresses.

- Outdated whitepapers / roadmaps. Promises that never happened, broken links, or milestones missed with no explanation.

Why care: Good docs show planning and accountability.

How to use: Read the whitepaper linked on their website. Check the dates on thier roadmaps – did they achieve them? When was it published? Was it revised?

- Dead social channels – Silent Discord, Telegram with bot messages, stale Twitter posts.

Why care: Communities drive growth and governance. Silence is bad news.

How to use: Join their channels, check message frequency and moderator activity.

Red flag: Long silence, unanswered official account questions, or obvious bot spam.

- No audits or unfixed security issues

No reputable audits, or audits with unresolved critical problems.

Why care: Unpatched vulnerabilities can mean lost funds.

How to use: Read audit reports from firms like CertiK, Quantstamp, Trail of Bits. Note critical issues and whether they were fixed.

Red flag: No audits or unresolved critical findings. Audit reports from firms like CertiK, Quantstamp, Trail of Bits

- Governance/treasury trouble

Empty proposals, drained treasuries, or opaque wallet activity. Why care: If funds or decisions are messed up, the project can’t respond to crises.

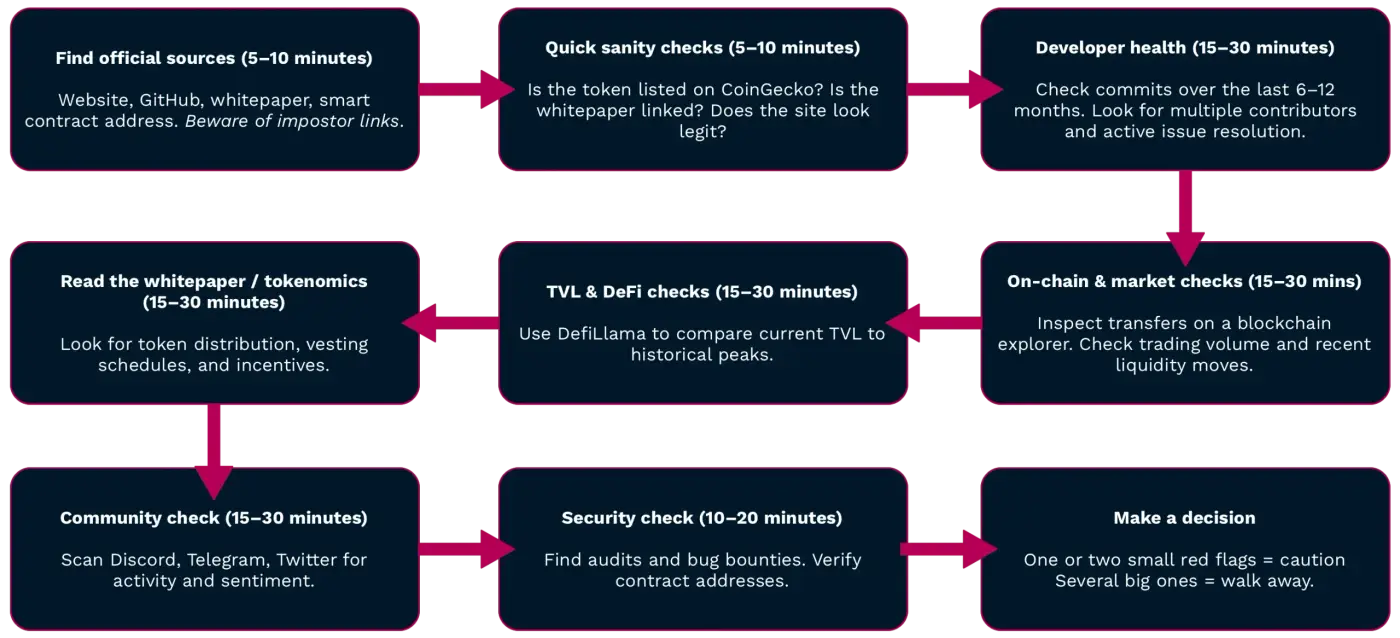

A simple due-diligence workflow (times are rough estimates)

Concrete thresholds (useful guidance, not gospel)

- Developer activity: fewer than ~3 commits in 6 months or <2 active contributors is worrying.

- Trading volume: average daily volume under ~$1,000 for months is a liquidity risk.

- TVL: if TVL falls under 10% of the peak and there’s no clear reason, that’s a problem.

- Community: long stretches of silence, or thousands of followers with zero real posts, often means fake engagement.

Short case studies — what the signs looked like

Terra / LUNA:

What happened: Algorithmic stablecoin UST lost its peg to the USD, triggering hyperinflation of LUNA and a collapse.

Signals: Heavy reliance on the swap mechanic without strong reserves, huge outflows and volatility.

Lesson: Algorithmic stablecoins are risky; always check reserves and stress scenarios.

FTT / FTX Token:

What happened: Token collapsed after the exchange faced liquidity and alleged misuse issues.

Signals: Centralized control and opaque treasury practices tied the token’s fate to the exchange.

Lesson: Don’t ignore counterparty risk. When an exchange is in trouble, affiliated tokens usually follow.

Axie Infinity (AXS):

What happened: Play-to-earn economics became unsustainable as growth slowed.

Signals: User metrics flattened, token emissions diluted value.

Lesson: Check long-term demand and whether token rewards are sustainable.

VegasCoin / Storeum (small-cap failures):

What happened: Ownership changes or lack of product-market fit led to abandonment and near-zero liquidity.

Signals: Team disappears, repo dead, social channels empty, tiny trading volume.

Lesson: Ownership transitions and product-market fit matter. If people don’t use it, the token won’t hold value.

Non-numeric red flags (behavioral, governance)

- Anonymous and evasive teams. Anonymity isn’t always bad, but don’t be kept in the dark.

- Fake social metrics. Tons of followers but no real engagement often means bots.

- Token ownership concentration. A few wallets holding most tokens can dump and crash the price.

- Legal/regulatory opacity. Repeated legal issues or dodgy jurisdictions increase risk.

How to limit losses — basic investment habits

- Diversify. Don’t put a large percent of your portfolio into a single small-cap token.

- Stagger buys. Use dollar-cost averaging to reduce timing risk.

- Size positions to risk. If there are minor red flags, keep position sizes small.

- Prefer audited, reputable infrastructure when possible.

- Plan your exit. Know where liquidity exists and use limit orders or sliced entries/exits.

Quick tools to bookmark

- GitHub / GitLab — code activity

- Etherscan / BscScan — token transfers and contract details

- CoinGecko / CoinMarketCap — market data

- DefiLlama / DappRadar / DeBank — DeFi analytics

- Discord / Telegram / X (Twitter) / Reddit — community checks

- Audit firms (CertiK, Quantstamp, Trail of Bits) — security reports

Final thoughts — be curious, not reckless

Dead coins are part of crypto’s natural cycle. What separates a savvy investor from a gambler is not luck — it’s process. A few quick checks (commits, transfers, TVL, volume, audits, and community health) will give you a huge edge. Keep a simple checklist, be skeptical of shiny marketing, and don’t be afraid to walk away when the red flags stack up. Look out for more ‘how to guides’ from BTC Nitro.