BRICS Central Banks Build on XRP Ledger

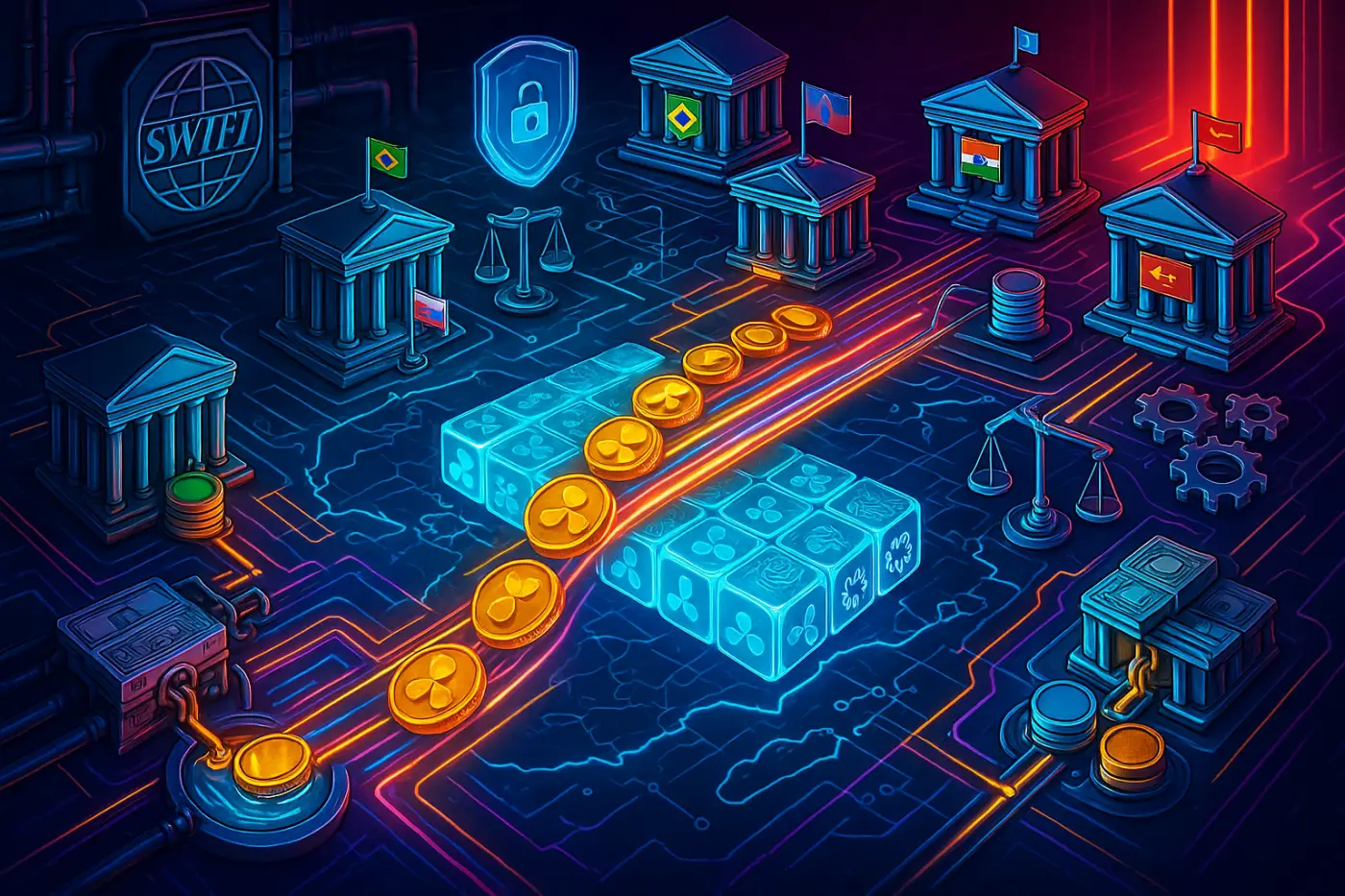

A growing initiative across BRICS nations is shifting attention from the Ripple vs. SWIFT debate toward practical deployment: several central banks in the bloc are exploring or building payment infrastructure on the XRP Ledger. The move signals renewed interest in distributed ledger technology for cross-border settlement and could accelerate experimentation with digital currencies and wholesale payment rails.

Using the XRP Ledger offers central banks a mature, low-latency ledger for near-instant settlement and built-in liquidity features, which appeals to authorities seeking alternatives to legacy correspondent banking and SWIFT messaging.

For BRICS members pursuing greater financial sovereignty and faster trade settlement, XRPL-based systems present a way to reduce reliance on existing global rails while enabling more direct, efficient cross-border flows.

- Regulatory alignment — central banks must harmonize rules across jurisdictions.

- Interoperability — integration with existing CBDC initiatives and legacy systems is required.

- Sanctions compliance — solutions must meet international sanctions regimes.

- Governance — robust frameworks are needed for sovereign use.

Integration work will also need to address on/off ramps, liquidity management, and privacy controls suitable for sovereign use. These operational and technical requirements are immediate challenges for any central-bank-level deployment.

If BRICS central banks proceed with XRPL deployments, the practical outcome could be a mosaic of interoperable payment solutions that emphasize speed and finality, reshaping regional cross-border flows.

Market participants should watch for pilot programs, technical standards, and regulatory signposts that indicate whether these efforts scale beyond experimentation into mainstream financial infrastructure.